If you had a million dollars, what would you do first? The sensible decision would be to invest, but the fun version would be to buy a million tacos.

When spending your company’s budget, you need to make rational decisions. A large project can benefit your company, but how do you prove it? You have to justify the spend to your CEO, or justify your spending to your board and investors.

Today, we’ll be discussing how to demonstrate ROI in your next meeting.

Summary

- When calculating ROI, make sure you keep Time Frame, Consistency, and Precision in mind.

- Before diving in, decide why your company needs this system. This will help you frame your ROI.

- Financial benefit is what most higher-ups want to hear; what money can be made or saved if we build this product?

- Consider more than just money when it comes to ROI: intangible benefits and your competition.

What is ROI?

Return on investment, abbreviated to ROI, is a percentage that compares investments and their efficiency. The calculation tries to measure how much money you’ll get back compared to the cost.

Formula

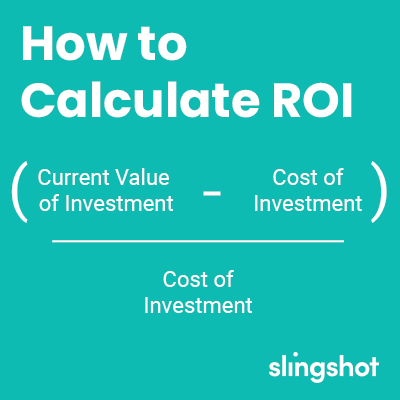

Since ROI is technically math, there’s a formula:

(Current Value of Investment−Cost of Investment) / Cost of Investment

Relevant Factors to Consider

Since the formula ROI is simple, there are some factors that need to be considered outside of the original formula:

Time Frame |

Consistency |

Precision |

| ROI does not consider the length of the investment. Without keeping the time frame the same across all calculations, your comparisons will be all off. | Once you start using ROI as a comparison tool, you need to use it across all your investments. This also applied to costs you’re including: have you considered inflation or taxes? | Rounding incorrectly may have caused you to get a C on your math exam, but doing so with ROI can cost you quite a chunk of change. To be as accurate as possible, you need to double-check your calculations. |

How to demonstrate ROI for Projects

Chances are your biggest investment has to do with technology. Before you even begin, you need to ask yourself two questions:

- Why does the company need this product?

- How will the company benefit from this?

Once you have these planned out, you’ll be able to make more educated decisions.

Related Article: The Ugly Realities of Software Development

Now for the moment we’ve all been waiting for: how do you truly figure out what the overall ROI for your project is?

Break into Phases

If you show an astronomical cost estimate out of the gate with a long timeframe to complete, chances are your proposal will be short-lived. Projects naturally have phases, so why not break the cost and ROI down a bit? Can you divide this investment into shorter and less expensive phases so your CEO and board can see real benefits earlier on in the investment?

Financial Benefit

The number-one thing you’re going to hear during your proposal will be about the financial benefits. A great project will increase profits and decrease expenses. Here are five ways to showcase the monetary benefit of your project:

- Revenue Enhancements – The literal money-maker. Will this project be able to increase your revenue?

- Cost Reductions – Are there any expenses you’ll be able to lower thanks to your project? Maybe you won’t have to use as much paper, or print as many tickets. Maybe less headcount could be used to run a division. In a company of growth these personnel could be devoted to other projects.

- Cost Avoidances – Avoiding a cost all together is even better than shrinking your costs. Are there costs that become no longer relevant after this big investment?

- Capital Reductions – Capital can be the silent-killer in a company’s budget. If your project could reduce your need for office space or equipment, you’ll be able to reduce capital expenditure.

- Capital Avoidances – Maybe you can avoid a capital expense altogether. If your company was planning on buying more storage, more equipment, hiring more personnel then show that you’ll be able to avoid these additional expenses with your project.

If you can prove that your project will increase the amount of money you bring in, save you money on expenses, or (best case scenario) both, you’ll be in a better position.

Competitors

Chances are you’ve done a competitive analysis before. You know what others in your industry are doing and how they’re doing it. Getting the advantage in an industry can make or break a company.

Do you know if any of your competition has a project similar to what you’re proposing? There’s two ways this can go:

If Yes… |

If No… |

| You’re already behind. You need to move forward with this project to stay in the game. | This is your chance to get the winning edge. If no one else has it, you’ll have the advantage. |

Intangible Benefits

So we’ve talked about the monetary benefit, but there’s more to it than just the bottom line. There’s intangible advantages to a new project.

Is it possible that you’re losing deals because you don’t have the right tools, processes, or offerings? Maybe this could be solved with new technology.

Following the same path, your customers’ happiness should be one of your highest priorities. Could a new project help with customer service or with any of the touch-points they have with your organization?

Another priority should be your employee’s moral. Does your staff have to file mountains of paperwork every week? A new software investment could help that and make their jobs easier.

Lastly, what about the opportunity cost? Is your team spending time and energy dealing with outdated processes or old technology?

You may not realize how much you’re losing because your staff isn’t able to focus on sales, growth, and being a better business. Don’t be afraid to bring up how much time you’re not spending on critical tasks when it comes to pitching your idea.

Cost

The biggest hurdle: how much will this whole endeavour cost? This is going to be your hardest sell to either your CEO or the board.

As we’ve already mentioned, breaking into phases is probably your best bet. By justifying the cost step-by-step instead of overall, you’re more likely to prove that the risk is worth the reward.

You don’t want to wait until the last minute to talk about the price, but you’ll also not want to start out-the-gate with it either. Talk about what your proposal is, the benefits, and then go into the cost. Afterwards, if you’ve still got an audience, you can go into how you plan to complete your project and deliver a solid ROI.

Conclusion

ROI on the surface is a simple formula of profitability. The more detailed you get, the more likely you are to walk out of your meeting with a smile on your face and a project in your future.

Make sure you consider all your factors to get the full scope of your investments, including the tangible and intangible benefits. Go in with a game plan, and come out a champion.

With all your new knowledge, you’ll be able to make rational investments. However, we do still recommend grabbing a taco or two with any leftover funds. ?